Bonds have gained their reputation for safety because they provide the greatest and most steady cash flows. Bond investors continue to think of their investments as the greatest way to save for the future. Bonds seem to be a simple investment option. However, successfully investing in bonds is a whole other ballgame. Bonds are deceptively complex instruments, and a single slip-up may have far-reaching repercussions. To help you make more informed investment choices, we've compiled a list of the most frequent blunders that bond buyers make, along with advice on how to avoid them.

Research Is Key

The good news if you're terrified of bond investing is that research simplifies matters considerably. The time and effort you put into studying and analyzing anything increases in value if you have a firm grasp of its language. You may be certain that your bond investment will be reimbursed at maturity, thanks to your diligent due diligence in the issuer. You may easily verify a company's track record of reliable earnings reporting by looking at its historical financials and performance.

It is also helpful to investigate a firm's management discussion &'' analysis (MD&''A) section as well as its proxy statement in order to get insight into whether or not the company is able to make payments. Future risks that might have a negative impact on a company's capacity to satisfy its debt commitments may also be revealed.

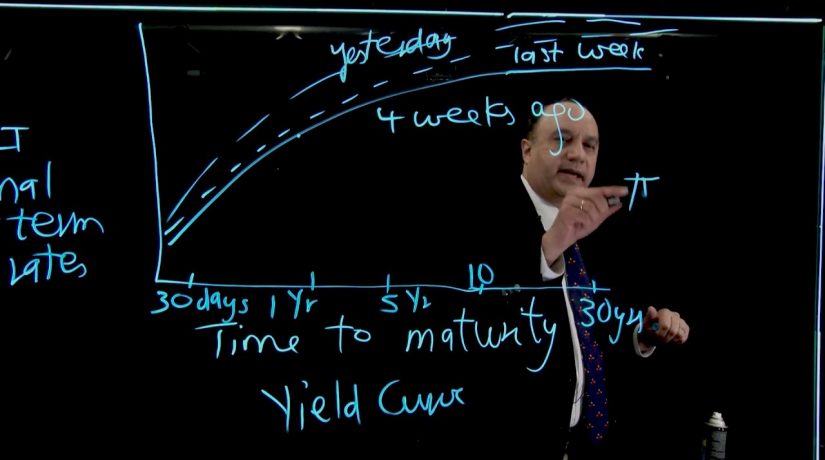

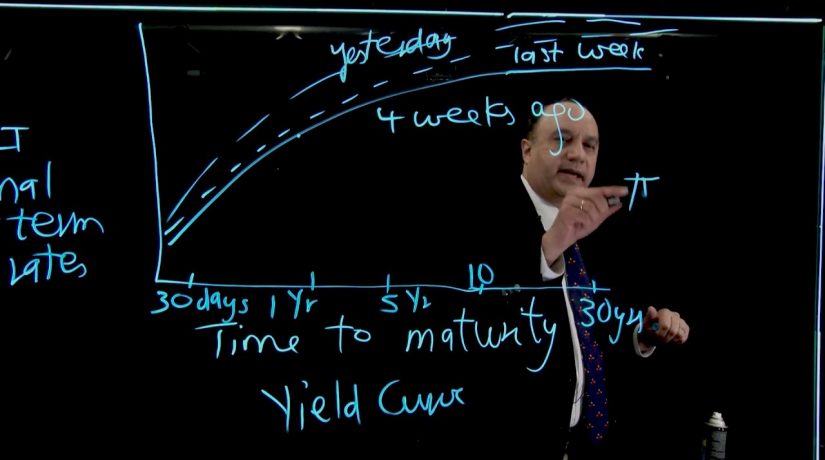

Ignoring Interest Rate Moves

There is a negative link between interest rates and bond prices. Bond prices fall as interest rates rise and vice versa. This implies that the price of a bond issuance will fluctuate greatly as interest rates do in the time leading up to the redemption date. Many stock market participants miss this point.

Is there anything that can be done to safeguard against these swings in the price? That question has a negative response. You can count on the volatility to persist. Due to this, holders of fixed-income securities should be ready to hold onto their holdings until the actual redemption date, irrespective of the length of the bonds' maturities. Selling a bond before its maturity date might result in a loss if the interest rate has changed adversely.

Assuming A Company Is Sound

There is no assurance that you will get a dividend payment or have your bond redeemed just because you possess a bond or because it is well regarded in the financial community. Traders seem to take this procedure for granted. However, before putting money into the investment, the investor should investigate the company's financials to make sure it has sufficient resources to meet its obligations.

They need to examine the income statement carefully, pull out the yearly net income number, and then factor in things like taxes, depreciation, and other non-cash costs. To see how frequently the value is more than the yearly debt payment amount, multiply it by 365. To be confident in the company's capacity to make debt payments, at least two times the amount of debt should be covered.

Disregarding Inflation

As inflation rises, bond interest payments will decrease in real terms. Therefore, when reports of inflation trends are made, investors must take notice. To keep up with the same standard of living, you'd need a return that's 4% higher each year if inflation were to increase at 4% annually, for instance. This is particularly relevant for bond investors who, by purchasing bonds at or below the rate of inflation, guarantee themselves a loss.

That doesn't imply you should avoid low-yielding bonds issued by a solidly creditworthy company. But in order to protect themselves against inflation, investors need to be aware of it. They need bigger returns from their other assets, such as ordinary stocks and high-yield bonds.

Failing To Check Liquidity

You may be able to learn more about the issue's liquidity by consulting financial magazines, market data/quote services, brokers, or a company's website. In particular, one of these may provide the average daily trading volume of the bond.

If bondholders ever decide to sell their holdings, they must have confidence that there are willing purchasers in the market to take over their stake. Stocks and bonds issued by larger, better-capitalized corporations are, in general, more liquid than those issued by smaller, less established corporations. The logic behind this is easy to understand: bigger businesses are presumed to be in a better position to meet their financial obligations.

Conclusion

When compared to stocks, bonds are generally safer and more conservative investments. However, there is a lot more work involved in fixed income investment than meets the eye. If you don't complete your research, you might end up with negative returns.