Introduction

Two of the most crucial components of a company's income statement are the bottom line and the top line. The net income of a firm is the ultimate measure of its success. Total sales made by an organization before deducting the costs of doing business is known as "top-line" revenue. The bottom line can be understood as the remaining funds after the following costs have been subtracted from the revenue:

- Direct costs of production such as labor and materials, Indirect costs, such as rent, utilities, and salaries, Loan and other debt interest rates, fees for depreciation and amortization, and Taxes imposed at the federal, state, and municipal levels.

- Both metrics are useful in evaluating business performance, but they do so differently. A rising top line, for instance, would represent an expanding company. It is a metric that evaluates a company's marketing and sales strategies over its rivals.

Divergence Between Top Line Growth Vs. Bottom Line Growth

Earnings growth can lag behind revenue growth for various reasons, especially among established businesses. Profits can expand significantly quicker than revenues if, for instance, the cost of a company's primary inputs drops dramatically or if it implements stringent procedures to keep costs in check.

However, only a select few businesses are in a position to enjoy revenue growth that outpaces inflation consistently. Even the most efficient business can only make so much money from a certain number of sales. A company's ability to achieve future profit growth will severely decline if its revenue growth has continuously outpaced its profit growth.

Nothing changes if annual profit growth undershoots annual sales growth. Suppose a company's profit growth rate is significantly lower than its revenue growth rate over a lengthy period (five to seven years). In that case, this is a red flag that the company's strategy for generating future profit growth is likely deteriorating and appears questionable. If the ratio continuously deviates by a wide margin, the value potential of the company's strategy is nearly exhausted, and troubles are on the horizon.

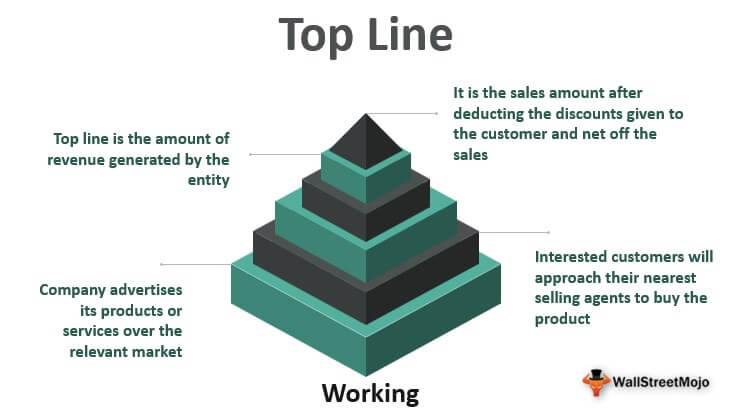

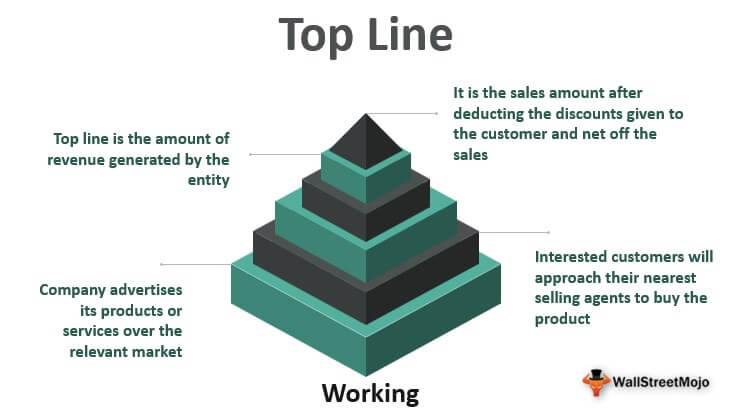

Top-Line Growth

If a company expands, it will likely see an increase in its top line, or revenue, due to more sales or efficient operations. Companies might focus on top-line growth by improving the efficiency of their marketing, releasing new items with higher prices, or implementing new sales strategies aimed at certain consumers. Increasing the company's market share can increase its top-line statistics. Although a rise in a company's top line often results in a rise in the bottom line, this is not always the case.

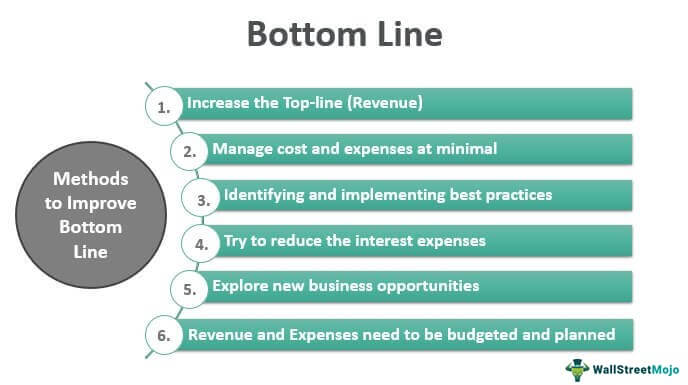

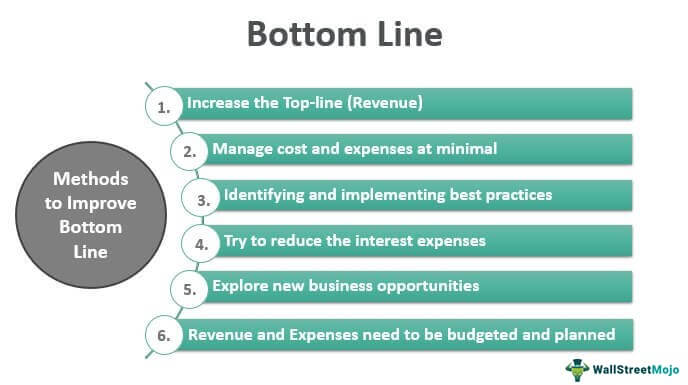

Bottom-Line Growth

Cutting costs is a surefire way to boost a company's bottom line. To accomplish this, you can use more efficient methods of operation. It could involve moving operations to a cheaper location or switching to a less expensive raw material. Financial gains can be increased further by taking advantage of tax breaks offered to businesses. To expand one's bottom line, one need not rely just on an expanding top line. Increasing the growth of revenue streams like passive investment income, interest income, or asset gains is one strategy to boost your bottom line without impacting your top line.

Top Line Growth Vs. Bottom Line Growth

While the top and bottom lines can provide insight into a company's financial health, it's vital to remember that a growing top line is not synonymous with a growing bottom line. The top line is the company's entire sales or revenue before deducting any expenses. Consequently, analysts may only gain insight into a company's sales-generating abilities by looking at the top-line numbers. The bottom line, however, considers a variety of expenditures and expenses and can provide analysts with a more comprehensive picture of a company's operational efficiency over a certain period. The most successful businesses simultaneously see increases in their top and bottom lines.

What Top- and Bottom-Line Growth Tell You About the Success of Your Business

The income statement provides a direct link between the top and bottom lines. Although not all businesses place equal emphasis on each, these factors are nonetheless important. Especially for businesses that have already received funding, the importance you place on expansion should be determined by the stage the company is now in. The early-stage mindset is one of "development at any cost." Your goal is to increase revenue as much as possible to fulfill the promise of the market opportunity you presented to your early investors.

Conclusion

While the top and bottom lines can provide insight into a business's health, they are not equivalent. Its bottom line reflects how well a business controls its expenses and allocates its resources. As opposed to the bottom line, which considers operational efficiencies, the top line merely shows how successful a corporation is at generating sales and money.