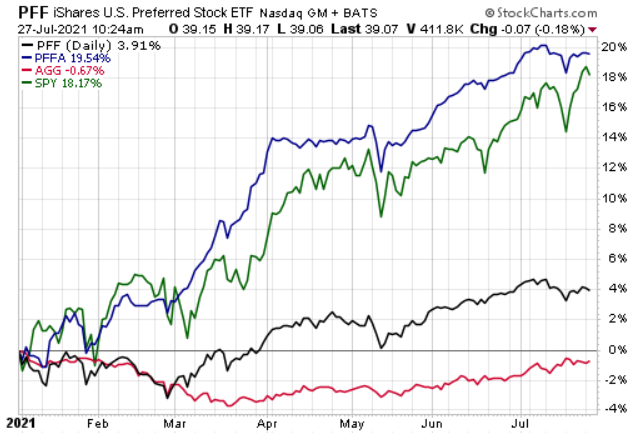

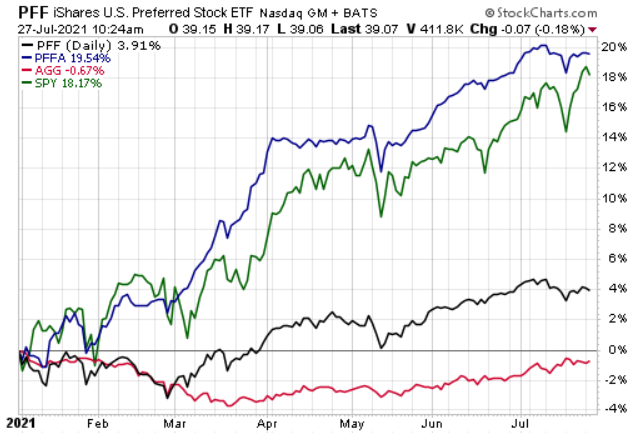

People buy corporate bonds and preferred stocks for the same reasons. They want to put their money into a long-term investment that gives them a fair and steady return. Exchange-traded funds, or ETFs, give investors a wide range of investments, such as preferred stocks and corporate bonds. Your choice depends on how the economy is doing and how you want to invest your money. If you want to make a lot of money, you might want to buy an ETF that invests in preferred stocks. This is very true while interest rates are decreased. People think preferred stock ETFs are better than mutual stock ETFs since they are less risky. You'll collect dividends and assets before regular stockholders. But when the market is going up, preferred stock ETFs tend to do worse than equity ETFs.

ETFs For Preferred Stocks

Preferred stocks combine a bond and a stock from the investor's perspective. They don't fluctuate in price as much as shares of common stock. The dividends that these shares pay are the critical point. Additionally, they are thought to be safer than regular equities. Preferred shareholders are prioritised for reimbursement even in the case of bankruptcy ahead of ordinary shareholders. A preferred stock ETF is something to consider if you're seeking a high yield. Due to their comparatively lower risk than typical stock ETFs, preferred stock ETFs are regarded as having more excellent quality. You will get dividends and any claims on assets before Common Shareholders. However, during bull markets, preferred stock ETFs perform worse than equities ETFs. Most bond ETFs provide cheap costs, high liquidity, and a diversified portfolio of bonds.

Preferred Stock (PFF) iShares ETF

The S &'' P U.S. Preferred Stock Index is tracked. Economic data as of February 28, 2022 Assets totalling $17.7 billion, 5,699,237 is the 30-day average volume. Cost Ratio: 0.46 percent trailing 12-month yield: 4.45%Date of Inception: March 26, 20073.-Year Results: 4.6The two preferred stock ETFs mentioned above may offer a high return and potential for appreciation, but they are not likely to perform as well as interest rates rise. Both displayed a lack of resilience by underperforming throughout the financial crisis. Bonds ETFs loan to a company in the form of a bond is provided in exchange for periodical interest payments. Similar to preferred stocks, bonds' appeal to investors lies in the consistent income they produce. One or more rating organizations provide a rating to each bond based on the issuer's creditworthiness. Despite paying the least, the bonds with the highest ratings are the safest.

High-Yield Bond SPDR Bloomberg Barclays ETF (JNK)

- Assets totalling $6.9 billion

- Volume on Average: 7,410,339

- Cost Ratio: 0.40 percent

- Yield over a year: 4.66%

- Date of Inception: November 28, 2007

- 3.9% throughout the past three years

- Twenty Plus Year Treasury Bond iShares

The Bloomberg Long United States Treasury Index is tracked. Economic data as of February 28, 2022.Assets totalling $15.6 billion in the past 30 days: 18,823,71 Charges: 0.15%Trailing 12-month yield: 1.5Date of Inception: July 22, 20023.-Year Results: 5.8%Nevertheless, these two options show the various circumstances in which yield, or a lack thereof, can be deceptive. Most investors chase high yields, unaware that doing so frequently increases their risk of devaluation. If an ETF's shares decline, a high yield is meaningless. That is TLT's appeal. Even while the yield is not very high (though still generous), it tends to increase during difficult times as investors flock to safety, aware that JNK was not chosen as the symbol for a fund that only purchases AA-rated bonds of the highest calibre.

Discover the Fundamentals of Trading and Investing

Due to their high yields, preferred stock ETFs are more desirable during periods of low-interest rates. In uptrends, they are less likely to advance as far as ETFs following common stocks. Bond ETFs are thought to provide better safety, but this can vary with every bond ETF. JNK, for example, has a high yield but is not a good investment during recessions when defaults are more likely. Although TLT may not provide as much yield, it does provide resilience, and the low expense ratio is an added benefit. Want to know more about investing and trading? Regardless of your favourite learning style, there are plenty of programs to get you started. Udemy allows you to choose courses taught by specialists in their industry and learn at your own pace with lifetime access on desktop and mobile. Additionally, you'll be able to learn the fundamentals of option spreads, day trading, and more.